PostNord has recently collaborated with HUI Research to publish a fresh report on the state of e-commerce in Sweden. It seems like sombre reading at first glance, but there are some great glimmers of light for the future of

e-commerce – read on to find out about the most important trends and opportunities based on the latest data in this report.

A truly wide-ranging e-commerce report

PostNord is the leading provider of parcels and logistics services to, from and within the Nordic countries, with around 28,000 employees, and HUI Research AB is a consultancy firm specialising in retail, tourism, consumption and economics. It was founded in 1968 as an independent subsidiary of the trade association Svensk Handel.

The report, called E-barometern, has collated data by surveying a total of 191 retail companies who sell goods online, and around 15,000 consumers over 12 months, with the latest in December 2022. The information from the companies was gathered in January this year, so these figures form the newest and most up-to-date intelligence on the Swedish e-commerce market that we have available.

In Europe alone, the medical technology market was estimated to be worth about EUR 150 billion in 2021, and despite a setback following the credit crunch of 2008, average growth over the past 10 years has been 4.8% per annum, with a growth rate of 2.9% in 2021.

The average spending in Europe on healthcare is around 11% of GDP, with 7.6% of that spent on medical technology, including medical devices. Additionally, out of the 15,300 patents filed with the European Patent Office, 41% were home-grown, i.e. from the UK and EEA or EU member states. 38% came from the US and 21% from other countries. As mentioned above, in 2021 two European countries – Germany, with USD 11.9 billion, and the Netherlands, with USD 11.7 billion. – were the top importers of medical instruments in the world after the United States.

This means that not only is there a solid level of innovation, development and sales of new products across borders within Europe, but it is also extremely lucrative to sell medical devices into the European market.

Rebalancing between physical stores and

e-commerce in Sweden

In another blog post, we wrote about the boom in online retail in the Nordics generally, with figures taken from the extraordinary rise in online shopping and home delivery that we saw during the pandemic.

It is therefore not altogether surprising that growth might begin to slow down once things started to get back to normal, but what is slightly surprising is that we have actually seen a decrease in e-commerce in Sweden:

“[…] for the first time in E-barometern’s history, [e-commerce] showed negative annual growth, falling by 7 per cent.”

The report points to several contributory factors that are all too familiar to most of us from our daily news – war, inflation, supply-line problems, etc. – but the steep rise in e-commerce during the pandemic was almost inevitably bound to rebalance once physical stores reopened. What’s interesting is to consider the overall trends as we now get used to the “new normal” – what is the direction of travel when it comes to online shopping in Sweden?

Online shopping trends – where are we going?

The sector with the largest share of e-commerce in Sweden is Home Electronics, accounting for 51% of the market in 2021 and 47% in 2022, so the reduction of 10% in online sales in that sector really makes a difference. Other sectors showing a fall are Children’s Items/Toys (by 16%); Books and Media, including audio books (by 10%); Furniture & Home and Sports & Leisure (both by 8%); and Building Products (by 3%).

One sector that is bucking the trend is Pharmaceutical Products, which are up by 10%. Interestingly, this is a sector dominated by older age groups, who only really embraced online shopping during the pandemic. It seems that many still find the convenience of shopping online and having the goods delivered worth continuing with. This is also a cohort with high levels of purchasing power and brand loyalty, but one that overwhelmingly prefers websites that are in their own language and are easy to navigate, as well as trustworthy.

Not all bad for e-commerce in Sweden

Apart from a dose of optimism from the Pharma sector, it’s easy to think it’s all doom and gloom and downhill from here – but this certainly isn’t the case. There are some very interesting and real opportunities breaking through the apparently gloomy statistical clouds.

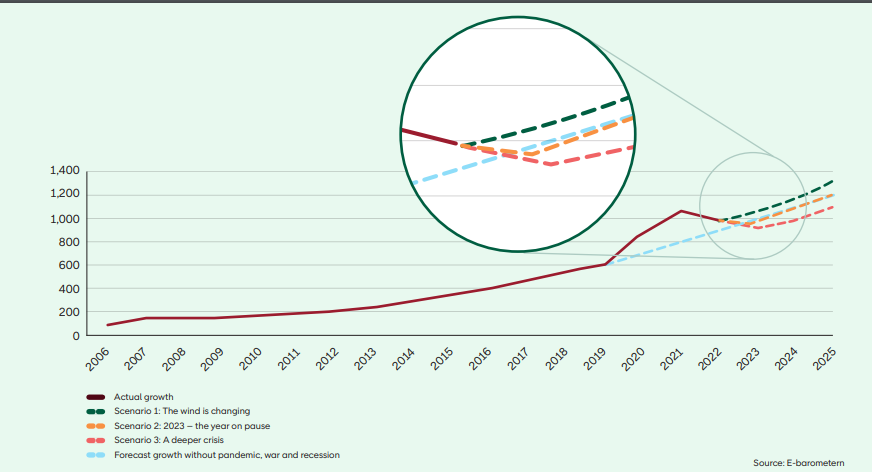

First of all, even with the net overall reduction in e-commerce of 7%, online sales are still up on 2019 by a significant margin, as this graph from the report shows.

The report discusses various future scenarios, but the commonality between them all is that they point to a steady increase in in e-commerce over the next few years.

What are the e-commerce trends showing us?

E-commerce has had a strong and increasing presence in Sweden and throughout the Nordics for many years. Scandinavians are generally quick to take up new technologies, and their relatively strong purchasing power on the global stage means that technological devices are more affordable to a greater number of people at pretty much all income levels.

As the report states: ”In 2003 net sales in e-commerce amounted to SEK 5 billion, accounting for around 1 per cent of total retail sales. Some 20 years later, in 2022, e-commerce had net sales of SEK 136 billion. This corresponds to a growth rate of more than 2,600 per cent”.

Greater urbanisation also means that it is cheap and easy to have things delivered, either to your home or to a pick-up hub, within 24 hours, with a greater focus on green delivery and sustainability – delivery to hubs has increased in recent years. For many, simply avoiding the crowds in the stores is reason enough to choose the convenience of ordering online.

Online payments and e-commerce

Furthermore, Sweden has seen a rise in convenient methods of paying online. The most popular way of paying online has long been with a trusty credit or debit card, with 80% of the 7000 respondents in a survey carried out by the online payment company Nets saying they had used one in the past three months to pay online, with “invoice” interestingly listed as the second most popular – something that is unique to Swedes.

But other payment methods have seen a significant increase in user popularity, especially in the younger age groups. The Nets survey saw 41% reporting that they had used a mobile payment option, Swish, in the previous three months in 2019, up from 28% in 2017. Among the 25–34 age group, the figure is 48%!

Other new players, such as Klarna, are also on the rise. Klarna specialises in Buy Now Pay Later (BNPL) or By Instalment services, and as such competes with credit cards or store cards. The BNPL sector is predicted to grow by 15.9% annually in Sweden between 2022 and 2028, so this is clearly an area to watch, not least as the economy puts a squeeze on many people’s budget – especially younger cohorts – and leads them to look for ways to make purchases more affordable and manageable.

Second hand, first choice

The economic squeeze, coupled with a concern for the environment and a wish to live more “sustainably”, are jointly contributing to another trend towards buying more second-hand items online. Traditionally, this was mainly the preserve of charity or vintage shops, as well as the online marketplace eBay, but the report predicts a boom in online second-hand purchases in 2023. Second-hand has been growing for years, but as the report states, the second-hand retailer Erikshjälpen has seen record growth month-on-month, and Tradera’s Christmas sales spiked by 24% from 2021 to 2022.

Apart from the external reasons for turning to second-hand shopping, one factor in its particular popularity online is a combination of affordability and convenience.

“In a physical second-hand store, it is hard to know if you will find what you are looking for, but online you can search for and find whatever you are looking for.”

It’s also interesting to note where the biggest gender differences are in online purchases. Women are twice as likely as men to buy clothing, footwear and home furnishings online, whereas men are three times more likely than women to buy home electronics and eight times more likely to buy vehicles or accessories for vehicles online.

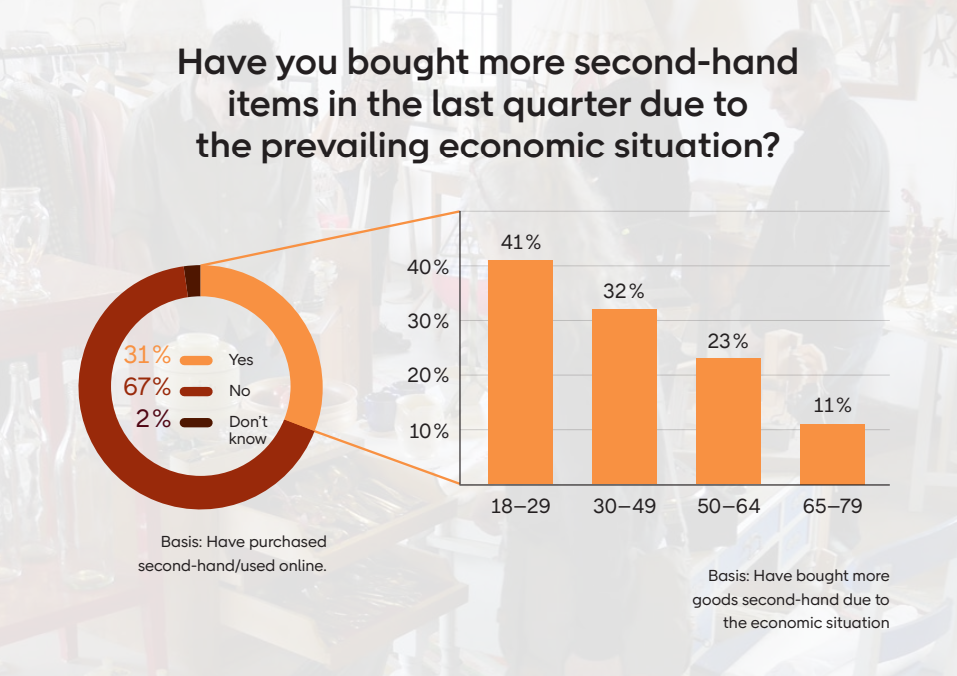

Another key difference between customers in the second-hand market relates to age groups. Customers in the youngest age group are almost four times more likely to buy second-hand than the oldest, as demonstrated in the graph below.

One reason for this is the aforementioned purchasing power of older customers, who are perhaps more likely to be the contributors of the items being sold a second time – after all, a second-hand market can only be derived from an associated first-hand market.

Marketplaces work

In addition to Erikshjälpen (a charity) and Tradera (a marketplace using bidding, like eBay), there’s also Vinted, for non-professionals and with a specific list of allowed categories, as well as more niche online shops such as Arkivet, specialising in clothing and fashion items for women. The latter has almost doubled its online sales since 2018.

Generally, marketplaces are the go-to for second-hand customers, with more than half of such purchases in 2022 made through the leading online marketplace Blocket, followed by Tradera in second place with 45%. Shopping through social media is also on the rise, with 38% of respondents having purchased through Facebook Marketplace.

It comes as no surprise, therefore, that the report states that “Companies selling via digital marketplaces are more positive about how their sales will develop in 2023.”

Amazon on the up

Other marketplaces, such as CDON, Afound and Amazon have a strong position, with 32% of men and 23% of women making online purchases through an online marketplace. The 18–29 age group has the highest share, totalling 37% and 27% respectively for men and women.

Amazon is a marketplace that is becoming increasingly popular with Swedes, featuring among the three best-liked e-commerce companies for the first time in 2022. Apotea still ranks first, with Zalando second. Consumers clearly enjoy what Amazon has to offer; in September 2022, Amazon Prime Video became the most downloaded entertainment app in Sweden, with over 40,000 downloads.

We can see another clear difference between generations here, with younger consumers being more attracted to websites such as Inet, Sellpy and Lyko, with older cohorts preferring Bokus, ICA and Engelsons. This is partly because the age groups consume different products, but also because they tend to buy from different kinds of companies.

Cross-border e-commerce

10% of consumers reported that they had shopped online from outside Sweden, and 6 out of 10 of these purchases were from Germany, China and the UK. Germany has seen an increase in online purchases from Sweden, accounting for 32% of online shopping from outside the country, followed by China at 15%.

Germany is popular not least due to its automobile industry, affordable spare parts and accessories, which make up a significant share of the imports.

Danish e-commerce has also grown in popularity in recent years; the plus points for the Danes are in furniture, design products and toys.

Basket abandonment remains a problem for e-commerce

Almost 8 in 10 online shopping baskets (77%) are abandoned without a purchase being made. The reasons for this vary between age groups, with window shopping – using your basket merely as a shopping list – being the most common reason among the young, and the lack of a preferred payment option, as well as the need to register an account, the most prevalent reasons among the older age groups.

Adding more payment and delivery options is one simple way to reduce basket abandonment. Convincing those who use the basket as a shopping list to take the next step is more difficult, but can potentially be done with the help of an effective special offer or some other incentive.

Good user experience (UX) design, preferably in the customer’s native language, is also extremely important. 97% of respondents mentioned “Good, clear information about products” as an important factor when deciding who to purchase from. 94% mentioned “Easy navigation” and 93% “Good search function on the website”. Having to guess or click around will not encourage these potential customers to complete a purchase on your website.

Say goodbye to cookies

For the up to 10% who abandon their basket or the 71%(!) who are put off altogether by having to register an account, guest purchasing options can be an easy solution. However, note another trend that is on the rise: no more cookies – and we’re not talking about curbs to your diet. There has long been a discussion around cookies – the small text files that websites store on a user’s computer to remember selected settings and preferences, used by third parties to collect data about users – and how this is squared with privacy concerns.

Google plans to phase them out by 2024 and Safari and Firefox already block many third-party cookies as it is. The conundrum is, if you can’t use third-party cookies and as many as 7 out of 10 consumers do not want to register before they buy, how do you collect their details so as to build a relationship with them and send them relevant offers?

One solution could be to offer special advantages – rebates, free delivery or similar – in exchange for their registering on your website.

Opportunities for e-commerce in Sweden

It is clear from the tendencies and trends we see in this report, corroborated by data from other sources, that e-commerce has a well-established presence in the Swedish market, and that there is significant growth potential to tap into as an online business, or a business with an online presence, for those retailers who can speak to the hearts and minds of the Swedish consumer.